Decentralized finance, or DeFi, is revolutionizing the fiscal landscape by leveraging the power of blockchain technology. This innovative approach disrupts traditional financial systems by enabling peer-to-peer exchanges without the need for intermediaries like banks.

DeFi applications, known as copyright, offer a range of services, including lending, borrowing, trading, and yield farming. These decentralized platforms operate on smart contracts, which are self-executing agreements written in code and stored on the blockchain.

The visibility of blockchain technology ensures that all transactions are recorded and verifiable, fostering trust and responsibility. DeFi's open-source nature allows for collaboration and continuous improvement by a global community of developers and users.

As DeFi continues to evolve, it holds the potential to enable individuals with greater financial freedom. By removing barriers to entry and providing access to economic services for all, DeFi is shaping a more inclusive and equitable future.

Algorithmic Trading in copyright

The copyright landscape is a dynamic and volatile realm, demanding tactical approaches for successful investment. Enter AI-powered trading, harnessing the power of artificial intelligence to decode market trends and execute advanced trades with unparalleled speed click here and accuracy.

These intelligent systems can recognize patterns, predict price fluctuations, and reduce risk, possibly offering traders a competitive edge in this volatile market.

- However, the integration of AI into copyright trading presents both opportunities.

- Traders must thoroughly assess the performance of AI-powered platforms and understand the underlying algorithms.

Ultimately, successful AI-powered copyright trading demands a blend of technical expertise, market knowledge, and a calculated approach to risk management.

Virtual Investments: A New Era for Investment

The sphere of finance is undergoing a dramatic transformation as copyright assets emerge as a promising investment opportunity. Traders are continuously drawn to the allure of these novel assets, hoping to benefit on their volatile nature. From Dogecoin to DeFi protocols, the diversity of digital assets is growing at an astonishing pace, providing both risks and rewards.

Conventional investment strategies are being transformed as the digital asset industry develops, requiring a shift in investor outlook. Understanding this complex landscape requires a deep understanding of the underlying principles, as well as a readiness to adapt to its unpredictable evolution.

Securing the Future: Blockchain Technology and copyright and

As technology evolves at a rapid pace, emerging innovations like blockchain platforms are poised to revolutionize various industries. copyright, fundamentally tied to blockchain, presents a novel approach to finance. P2P in nature, these systems offer enhanced security, auditability, and efficiency. While challenges remain regarding regulation, the potential benefits of blockchain and copyright are undeniable, opening the way for a more resilient future.

The Symbiosis of AI and Finance: Transforming Digital Markets

The financial sector experiencing a seismic shift as Artificial Intelligence (AI) emerges as a transformative force. This unprecedented synergy of AI and finance is revolutionizing digital markets, generating new opportunities and redefining traditional paradigms.

Leveraging the power of machine learning, AI algorithms can analyze vast datasets with remarkable speed and accuracy, revealing hidden patterns and trends that were previously inaccessible to human analysts.

- This enhanced insight empowers financial institutions to make more strategic decisions, enhancing operations and providing personalized customer experiences.

- Additionally, AI-powered chatbots and virtual assistants are transforming customer service in the financial sector, offering 24/7 support and accelerating routine tasks.

Therefore, the symbiosis of AI and finance is poised to revolutionize digital markets, spurring innovation, boosting efficiency, and facilitating a more inclusive and accessible financial system for all.

Exploring Decentralization: copyright and its Global Reach

copyright has emerged as a groundbreaking force in the financial world, challenging traditional structures. At its core, copyright is founded on a technology known as blockchain, which enables secure and transparent transactions without the need for a central institution. This decentralized nature of copyright has far-reaching implications across various sectors, from finance and trade to governance and development.

- Additionally, the utilization of copyright is continuously growing, with an increasing number of individuals, businesses, and even governments exploring its applications.

- Understanding the fundamentals of decentralization is essential for comprehending the true impact of copyright on our world.

Despite its promise, copyright also presents certain concerns. These include price fluctuations and the need for robust governance to mitigate potential abuse.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Soleil Moon Frye Then & Now!

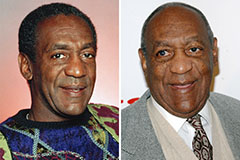

Soleil Moon Frye Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!